Guard Which Used a Standard Cost Accounting System Manufactured

Dock Guard which uses a standard cost accounting system manufactured 210000 boat fenders during the year using 1780000 feet of extruded vinyl purchased at 130 per foot. Define the components of a standard cost card and list its benefits for cost manage-ment.

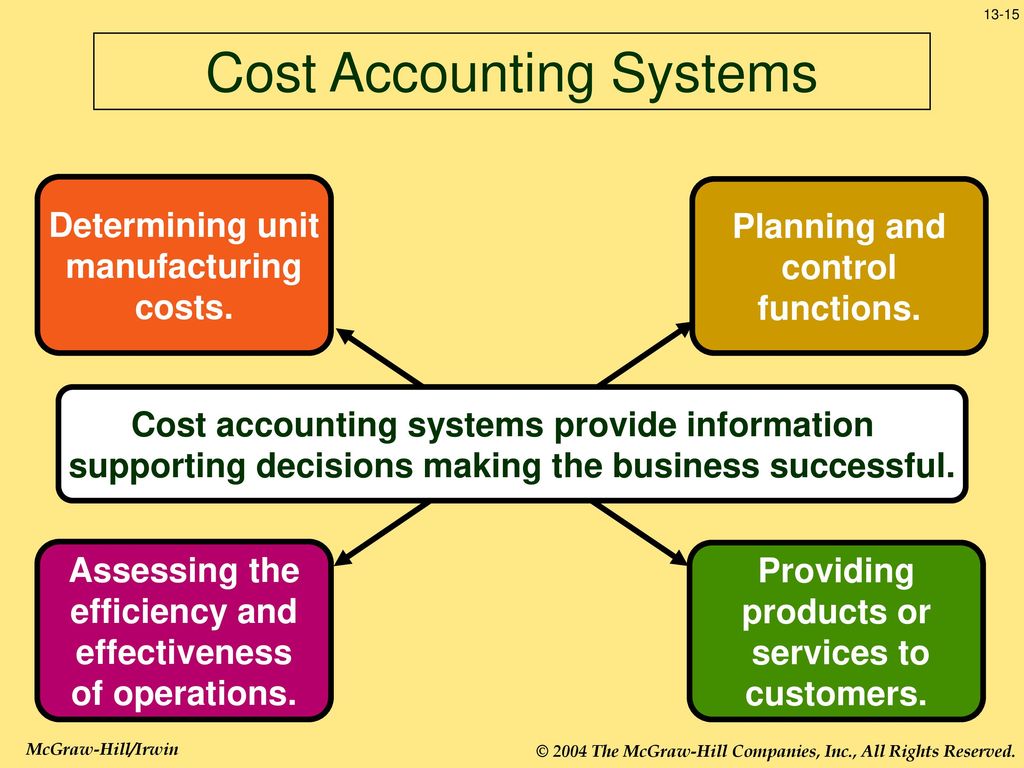

Cost Accounting And Reporting Systems Ppt Download

Guard which uses a standard cost accounting system manufactured 180000 boat fenders during the year using 1540000 feet of extruded vinyl purchased at 135 per foot.

. The materials standard was 6 feet of vinyl per fender at a standard cost of 150 per foot. Superior Guard which used a standard cost accounting system manufactured 220000 boat fonders during the year using 1420000 feet of extruded vinyl purchased at 105 per foot Production required 4900 direct labor hours that cost 1500 per hour. The materials standard was 8 feet of vinyl per fender at a standard cost of 120 per foot.

In your apron business the main direct material is the denim. The standard cost of a product is the estimated cost of production provided normal operations and a reasonably minimal amount of waste defect and spoilage. The direct materials standard was 7 square feet of vinyl per fender at a.

Production required 4400 direct labor hours that cost 1200 per hour. In a food manufacturers business the direct materials are the ingredients such as flour and sugar. Production required 4600 direct labor hours that cost 1400 per hour.

The materials standard was 8 feet of vinyl per fender at a standard cost of 150 per foot. Hull Guard which used a standard cost accounting system manufactured 220000 boat fenders during the year using 1590000 feet of extruded vinyl purchased at 115 per foot. Setting Standards LEARNING OBJECTIVES After studying this chapter you should be able to.

Production required 4600 direct labor hours that cost 1600 per hour. Superior Guard which used a standard cost accounting system manufactured 220000 boat fonders during the year using 1420000 feet of extruded vinyl purchased at 105 per foot Production required 4900 direct labor hours that cost 1500 per hour. The materials standard was 7 feet of vinyl per fender at a standard cost of 130 per foot.

This approach represents a simplified alternative to cost layering systems such as the FIFO and LIFO methods where large amounts of. These systems start with the establishment of a standard cost. Direct materials are the raw materials that are directly traceable to a product.

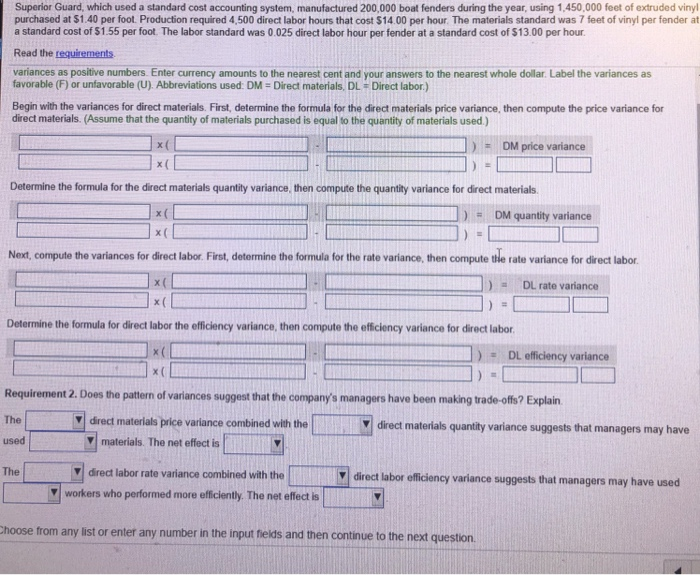

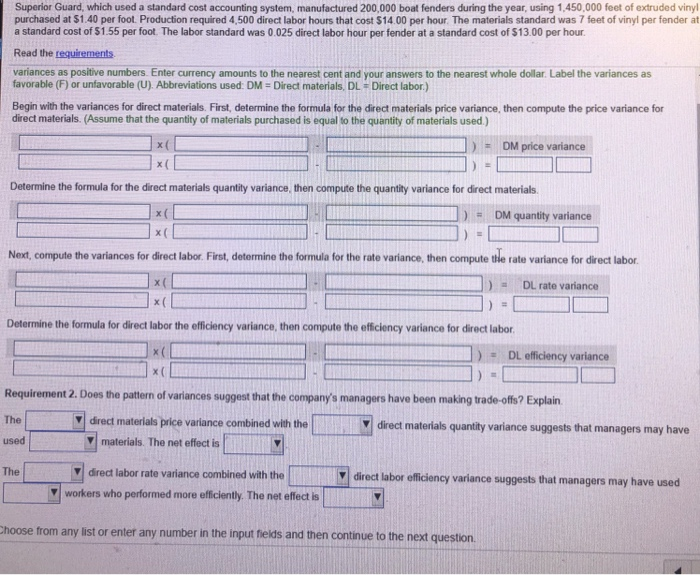

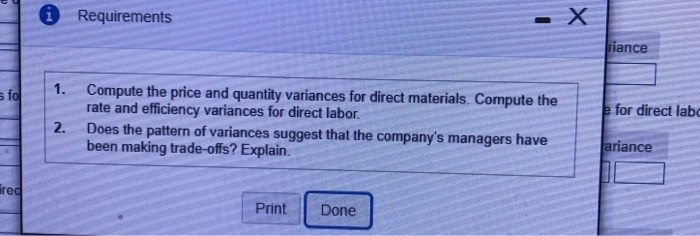

The standard cost rollup for a manufactured product is made up of direct material direct labor overhead and indirect costs. Increase factory overhead decrease materials inventory. Compute the cost and efficiency variances for direct materials and direct labor.

The materials standard was 6 feet of vinyl per fender at a standard cost of 1 30 per foot The. Calculating materials and labor variances Matthews Fender which uses a standard cost system manufactured 20000 boat fenders during 2018 using 143000 square feet of extruded vinyl purchased at 130 per square foot. Superior Guard which used a standard cost accounting system manufactured 240000 boat fenders during the year using 1540000 feet of extruded vinyl purchased at 140 per foot.

Increase materials decrease work in progress. Standard costing is the practice of substituting an expected cost for an actual cost in the accounting records. Best Guard which used a standard cost accounting system manufactured 240000 boat fenders during the year using 2020000 feet of extruded vinyl purchased at 115 per foot.

Describe the role of the modern management accountant and the CAS in cost manage-ment. Production required 4900 direct labor hours that cost 1550 per hour. The Standard Cost Accounting System Part I.

E23-19 Calculating materials and labor variances Great Fender which uses a standard cost accounting system manufactured 20000 boat fenders during 2014 using 144000 square feet of extruded vinyl purchased at 105 per square foot. E23-19 Calculating materials and labor variances Great Fender which uses a standard cost accounting system manufactured 20000 boat fenders during 2014 using 144000 square feet of extruded vinyl purchased at hour per fender at a standard cost of 1250 per hour. Increase work in progress decrease supplies.

Production required 4000 direct labor hours that cost 1650 per hour. The materials standard was 8 feet of vinyl per fender at a standard cost of 140 per foot. In an automobile assembly plant the direct materials are the cars component.

Subsequently variances are recorded to show the difference between the expected and actual costs. The materials standard was 6 foot of vinyl per fonder at a standard cost of 115 per foot. Guard which uses a standard cost accounting system manufactured 230000 boat fenders during the year using 1710000 feet of extruded vinyl purchased at 115 per foot.

Production required 400 direct labor hours that cost 1600 per hour. Standard Cost and Price Variance. Premium Guard which uses a standard cost accounting system manufactured 190000 boat fenders during the year using 1 comma 380000 feet of extruded vinyl purchased at 130 per foot.

At the end of each period you compare the amount of materials labor and overhead costs used in production to the standard. Best Guard which used a standard cost accounting system manufactured 170000 boat fenders during the year using 1070 000 feet of extruded vinyl purchased at 125 per foot. Production required 4800 direct labor hours that cost 1200 per hour.

Production required 4300 direct labor hours that cost 1650 per hour. The materials standard was 6 foot of vinyl per fonder at a standard cost of 115 per foot. The direct materials standard was seven square feet of vinyl per fender at a standard.

The materials standard was 7 feet of vinyl per fender at a standard cost of 130 per foot. Production required 4200 direct labor hours that cost 1350 per hour. Increase work in process decrease materials inventory.

In a job order cost accounting system the effect of the flow of direct materials into production is to. Following actual raw material consumption there is a tendency to not record point-in-time information for fear of making mistakes or making errors while not tracking what was altered from standards and causing a variance. Production required 420 direct labor hours that cost 1350 per hour.

Solved Dock Guard Which Uses A Standard Cost Accounting Chegg Com

Solved Superior Guard Which Used A Standard Cost Accounting Chegg Com

Solved Superior Guard Which Used A Standard Cost Accounting Chegg Com

No comments for "Guard Which Used a Standard Cost Accounting System Manufactured"

Post a Comment